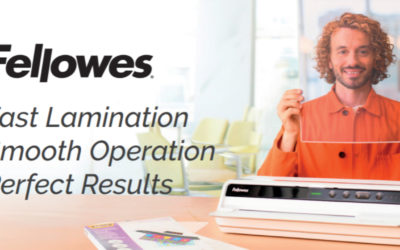

Many businesses are likely to have piles of paperwork and business records related to employees, tax, incomings and outgoings. While all this paperwork is necessary to the running of the business, keeping it can present a space problem unless you happen to have vast filing cabinets.

Knowing which business records you need to keep and for how long can improve your filing system and means you’ll know where your important documents are if you ever need to retrieve them.

Physical vs digital

A lot of your paperwork can be stored electronically. Just make sure your digital records capture all of the information on each document, both front and reverse, and that you have sufficient back-up plans in place to protect yourself from the risk of records being lost or deleted. It’s good practice to have physical versions of some important documentation, especially as you may sometimes need to submit physical paperwork as part of your tax and employment records.

What business files should I keep?

The specific records you need to keep will vary depending on the type of tax you have to pay. The following are the most common records that you must retain:

- All Pay as You Earn records – Every employer is required by law to keep accurate records of all payments made to employees, deductions made for income tax, national insurance and student loan payments, as well as any statutory payments.

- Sales and takings – You should take care to retain all of your till rolls, sales invoices, bank statements, paying-in slips and accounting records, including cash receipts, so that you can easily demonstrate what you are owed and prove your total income.

- Purchases and expenses – You should also keep all of your receipts, purchase invoices, bank and credit card statements, chequebook stubs, motoring expenses and mileage records and accounting records, including cash purchases, so that you can show what you have spent, how much you owe and what you can claim back for tax purposes.

- Assets, liabilities, income and expenditure – If your business is a limited company, you need to keep all of your accounting and business records, including bank statements, paying-in slips, account books, purchases and sales information, to prove the financial position of your business and comply with the Companies Act. They will also help you to calculate how much Corporation Tax you need to pay or reclaim.

- All VAT records – If your business is VAT registered, you are required by law to keep track of all of your VAT accounts, including VAT sales and purchase invoices, and any import and export documents such as delivery notes.

- Construction Industry Scheme (CIS) records – Under the scheme, if you’re a CIS-registered contractor you are legally required to maintain full records of any payments made, deductions taken, and materials purchased by subcontractors for at least the last three years. This will help you to work out your CIS deductions and complete the relevant returns.

- Benefits records – You should also keep on file any paperwork relating to statutory sick pay, statutory maternity, paternity or adoption pay and any employee benefits.

How long should I keep tax records and bank statements?

You should typically keep tax records and bank statements for a minimum of three years. Tax records should be kept for at least three years from the day you filed the original return. Bank statements can be stored online as part of your online banking facilities as printed off as and when you need them, though it’s good to keep at physical statements for the past few months to hand at least.

How to keep paperwork in order

To keep your paperwork in order and easy to retrieve, you should establish a clear filing system for hard copies, as well as an appropriate digital or cloud storage file. You can then break each file down by year, quarter or month as you see fit. How granular you make your filing system will depend on your business’s specific requirements, so it’s worth asking your accountant what they require.

A thorough filing system is like an insurance policy – it means you’re prepared for the worst, like if you are asked to provide additional information or copies of documents. Good record keeping can also be useful for assessing your business’s financial health, applying for loans, seeking investment, or going after new business.

Find out more about filing documents and office essentials with Staples.